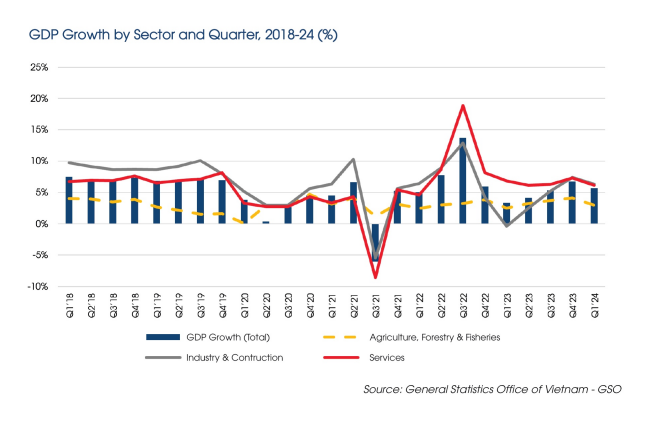

The Gross Domestic Product (GDP) growth in the first quarter of 2024 reached 5.7% compared to the same period last year, marking the highest growth rate in the first quarter during the period of 2020 – 2023, providing a positive signal following the challenges of 2023. All three sectors including Industry and Construction; Services; Agriculture, Forestry, and Fisheries witnessed upticks compared to the same period in 2023. However, there were variations in growth rates among these sectors compared to the targets set forth in Resolution 01/NQ-CP. Among them, the Industry and Construction sector exhibited the strongest improvement among the three sectors (approximately 6.3%, with the industrial sector alone increasing by 6.18%), significantly surpassing the targets set in the Resolution (5.5%). The other two sectors also experienced positive growth, albeit at lower rates compared to the targets outlined.

Attracting FDI in the Asian region is currently led by East Asian countries (primarily China, Hong Kong, and Japan). Southeast Asian countries are currently in second place in attracting FDI in the region. Especially, achieving a good growth rate in 2021 (79%), and maintaining a slight growth in 2022 while East Asia saw a slight decrease in FDI inflows, Southeast Asia still maintained a modest growth rate (5%). Vietnam ranks third in the region in attracting FDI, after Singapore and Indonesia.

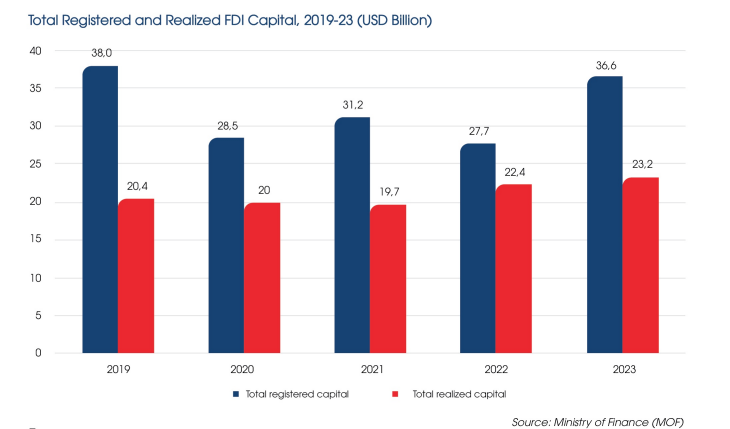

As of the end of 2023, total foreign direct investment (FDI) into Vietnam reached $36.6 billion, marking a 32.1% increase compared to 2022 and nearing the $38 billion milestone before Covid-19 (in 2019). In terms of the total FDI realized, 2023 recorded the highest figure since 2019, reaching $23.2 billion.

The total import-export turnover in the first quarter of 2024 reached $178.040 billion, the highest level for the first quarter in the period of 2020 – 2023, indicating a revitalization of international trade activities since the onset of the Covid-19 pandemic in 2020 and amidst a challenging year like 2023. The trade surplus continued its growth momentum since 2022, reaching $8.080 billion in the first quarter of 2024, a 98.5% leap compared to the same period last year. The FDI sector remained the primary export sector with a 69.2% share of the total import-export turnover in the first quarter, growing by 13% in value compared to the first quarter of 2023, achieving a trade surplus of $12.57 billion. The domestic sector, on the other hand, incurred a trade deficit of $4.49 billion.

The number of enterprises ceasing operations reached a dominant figure in both the Manufacturing and Construction industries, with increases compared to the same period last year at 19.5% and 15.7% respectively, indicating significant ongoing challenges in the business landscape. Particularly in the Construction industry, the number of enterprises ceasing operations reached the highest figure (7,064 enterprises) within the Industry & Construction sector, while the number of enterprises returning to operations decreased by 1.2% compared to the same period last year due to difficulties in the real estate market and capital market. Specifically, comparing the number of newly registered and returned-to-operation enterprises with the number of enterprises withdrawing from the market, in the first quarter of 2024, the total number of Construction enterprises decreased by 518, while the number of Manufacturing enterprises increased by 273.

Status Of Newly Registered Industrial Construction Projects In Quarter I/2024

In the fourth quarter of 2023, the number of projects attracted to Vietnam decreased compared to the third quarter, but the total investment level increased significantly. The investment attraction situation in the first quarter of 2024 increased compared to the first quarter of 2023, with new FDI projects in the first quarter of 2024 showing a clear growth. Vietnam is increasingly affirming its potential to attract large-scale investments, especially for large projects, which is considered a top priority in the national economic development plan.

“According to data from the HOUSELINK system, in the first three months of 2024, land lease projects accounted for a significant proportion, with over 60% of newly registered construction land lease projects. The number of land lease projects in the first quarter of this year also nearly doubled compared to the same period in 2023”

In the period from 2023 – Q.I/2024, the factory rental projects reached the peak in the number of projects in the third quarter of 2023. By the fourth quarter of 2023, the number of projects started to decline, and in the first quarter of 2024, there is a slight upward trend. The number of factory rental projects is still maintaining an increasing trend up to now. However, when considering the proportion of factory rental projects out of the total number of newly registered projects, there is also a downward trend. Even during Quarter III/2023 when the number of factory rental projects reached its highest, the proportion over the total number of projects still decreased, and this trend has persisted until now. It can be observed that after a period of booming workshop rental projects driven by investors needing to quickly operationalize to meet order demands, this trend is now showing signs of slowing down and gradually decreasing.

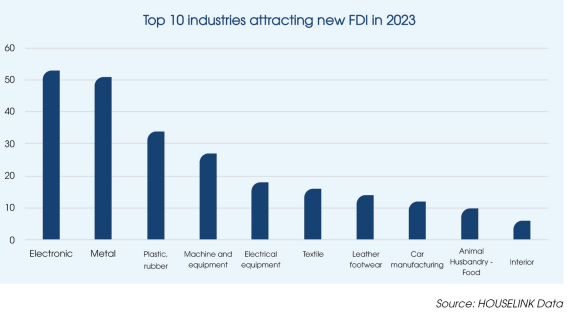

The electronics industry leads the top 10 sectors attracting investment projects in the first three months of 2024, with these projects mainly concentrated in the Northern region. Over the past two years, due to the government's clear policies in attracting investment with strict criteria for selecting investment projects based on both quality and quantity, there hasn't been much change in the sectors attracting investment. Ranking second are projects in the metal industry, followed by the plastic-rubber and machinery equipment sectors. Particularly, the automotive manufacturing sector also appears in the top 10 sectors attracting investment in the first three months of 2024 (primarily projects producing automotive components). Although the textile and garment, and leather and footwear industries have decreased both in the number of investment projects and registered capital, they still remain among the top 10 industries attracting the most investment in Vietnam in Quarter I/2024.

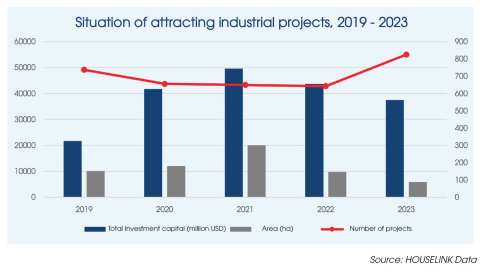

Situation Of Attracting Industrial Projects In 5 Years (From 2019 To Present)

In 2023, the HOUSELINK system recorded 825 projects, an increase of 28% compared to 2022 and the highest in the last five years, although the total investment decreased slightly (14% compared to 2022). The impact of the COVID-19 pandemic and global geopolitical issues also affected the industrial investment trend, resulting in a slight decrease in the number of industrial land lease projects with capital over 2 million USD in Vietnam from 2020 to 2022, although the reduction was not significant. In 2023, there has been an improvement and growth in the number of projects. The highest total investment was recorded in 2021 due to several large investment projects that year.

In the first quarter of 2024, DDI projects still dominate the majority of industrial investment projects over 2 million USD in Vietnam. Following them are Chinese FDI and South Korean FDI. DDI and Chinese FDI are currently holding the largest share of investment in Vietnam, accounting for nearly 70% of the market. Observations show that DDI has the largest change in market share, increasing by 8% compared to the fourth quarter of 2023. Chinese FDI and Taiwanese FDI have seen decreases in the number of investment projects (decreasing by 3% and 8% respectively compared to Q4/2023). Investments from South Korea and Singapore have recorded slight increases (1% and 1.4% respectively).

Overview Of The Situation Of Industrial Projects Under Preparation For Construction In Vietnam

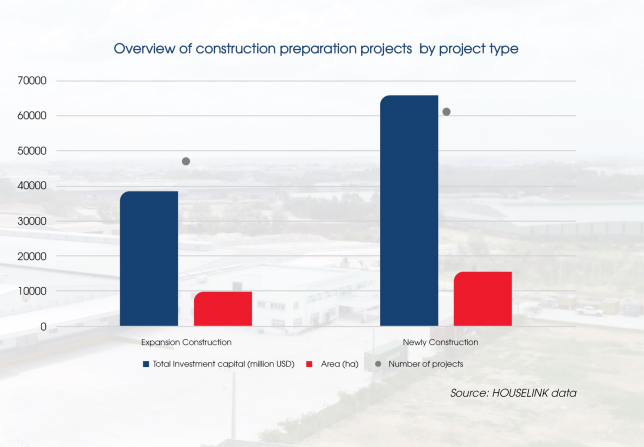

According to data from the HOUSELINK system, we observe a significant difference in total investment between expansion projects and new construction projects, but the number of projects does not differ much. New construction projects, in particular, have a higher proportion both in terms of quantity and total investment. Both types of construction involve the presence of large projects, although the number of such projects is not extremely high. Through attracting new projects along with their superior capital compared to expansion projects, we can see the confidence of new investors in joining production alongside the significant development potential in the Vietnamese market.

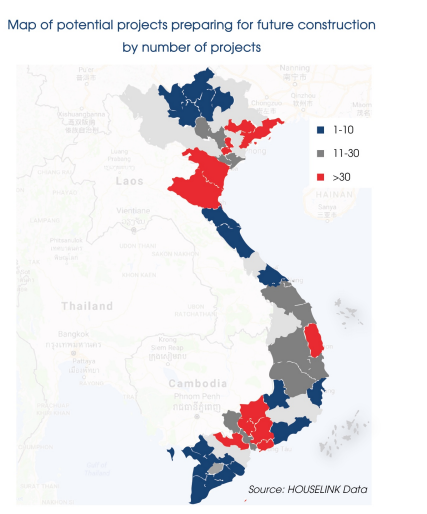

HOUSELINK data indicates that the majority of projects preparing for construction are concentrated in the Northern region, primarily in provinces such as Bac Ninh, Hai Duong, and Hung Yen. This region is also home to many large investment projects nationwide. The number of projects in the Central region is the lowest among the three regions. However, the Central region has the characteristic of being an investment destination for many energy projects, pushing the investment capital scale of projects in this region to the highest among all three regions.

.png)