In the second quarter of 2022, the country’s GDP growth is estimated to increase 7.7% compared to Q2/2021 according to the calculations of the General Statistics Office of Vietnam. This is the highest Q2 growth rate in 10 years. In the context that the world situation is still complicated with inflation shock in many countries at the beginning of 2022 and Vietnam is in the first stage of growth after the pandemic, this growth finger is really impressive, showing that the economy is getting thriving. In which, more than 39% contributed to the increase from the Industry and Construction.

In the first 6 months of 2022, IIP in Vietnam increases about 9%, of which the manufacturing industry increases the most by about 10%. The total of the IIP and the manufacturing industry in 2022 are lower than the growth rate of the same period in 2021 and only higher than the rate of 2020, almost equal to the rate of the same period in 2018. Despite maintaining the growth rate from appearing the pandemic, the world’s price fluctuations, rare materials, especially the price of materials increases highly due to Russia-Ukcraine war and China’s Zero-covid policy has restrained the growth of product output.

Some factors directly affect to attracting of investment capital to the industrial park

At the end of 2020, according to GSO’s survey, Vietnam is in a golden population structure. In which, people of working age from 15 years old and above are evenly allocated among regions and the number of workers in the industry and construction tends to grow.

The government prepares to apply many policies to attract and promote investment

Replacing for Decree No. 82/2018/ND-CP on the management of Industrial parks and Economic parks is Decree No. 35/2022/ND-CP on the management of Industrial parks and Economic parks which is officially effective from July 15th, 2022. This new decree is expected to help improve the business and investment environment, and reduce administrative formalities for enterprises…

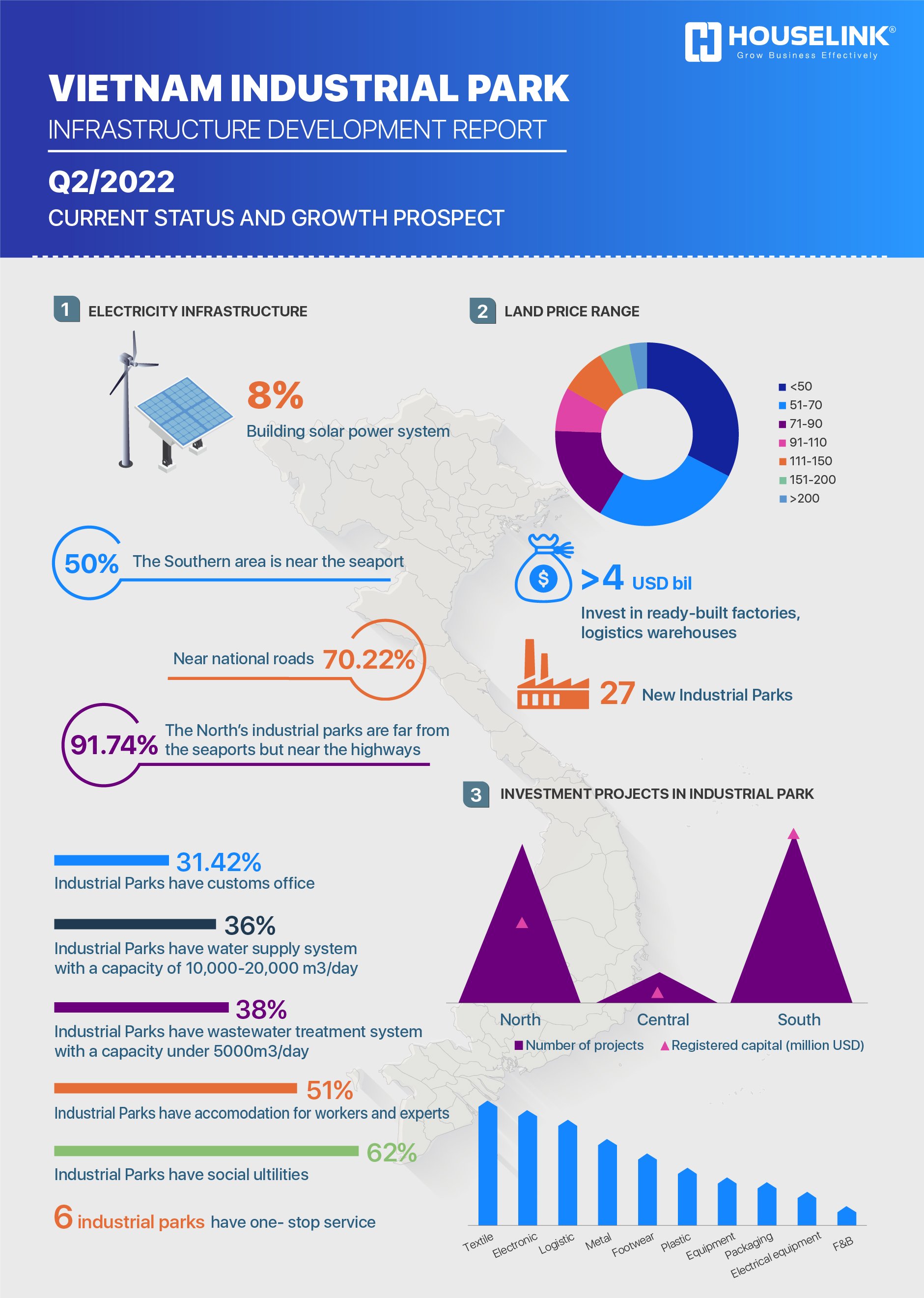

Current status of developing the industrial park infrastructure

According to HOUSELINK’s survey about the internal transportation infrastructure of 277 industrial parks in the country, the construction of some roads around the industrial parks has basically met the design standards of internal transportation infrastructure of industrial parks. Accordingly, using 4 main road lanes and 2 side road lanes accounts for the majority (nearly 70%), especially industrial parks operating from 2003 to 2009 because this is a period that many industrial parks were built and came into operation.

When we delimit the industrial parks in regions according to distance group to the nearest highway, airport, or seaport. The central region is bordered by the sea so the industrial parks are close to the seaport (57.75% of the total of the center’s industrial parks) which is convenient for export-import and trading goods. And in the South, the industrial parks near the seaport also account for 50%. In contrast to the Central, the North’s industrial parks are far from the seaports but near the highways (91.74% of the total of the North’s industrial parks).

According to our survey and research, currently, more than 70% of the industrial parks in the country use electricity from the national power grid with a capacity of 22/110kV. In recent years, industrial parks start to pay attention to the use of renewable electricity from solar and wind power. About 8% of the industrial parks have built solar electricity systems in the area. The construction projects of renewable power factories are being built with a steady frequency every year and more and more factories are installing rooftop solar panels. When the investors especially FDI investors are really interested in the use of renewable electricity and green technology, combined with the State’s policy to achieve net zero emissions by 2050, the industrial parks use renewable power, build wastewater, and waste treatments will contribute to attracting more quality investment capital. Especially, developing eco-industrial parks, and attracting green investment capital are becoming a tendency not only in the world but also in Vietnam. There are 5 industrial parks that are tested to apply the eco-industrial park model with high efficiency in emission reduction, some of the investors of big industrial parks are gradually transferring this eco-industrial park model.

The majority of the industrial parks in the country built water supply systems with a capacity of 10,000-20,000 m3/day (36%). Regarding the wastewater treatment system, most of the parks have a wastewater treatment system with a capacity under 5000m3/day (38%). Particularly in the South, for the industrial parks with a distance of less than 30km compared to Ho Chi Minh City, nearly 45% of the industrial parks have a wastewater treatment capacity of 5,000- 10,000 m3/day.

Currently, most industrial parks have not had any accommodation for workers and experts. This is a serious issue because most of the industrial parks are far from the center, residential districts, and workers’ and experts’ moving is inconvenient. According to our research, about 50% of the total industrial parks in the country have not had accommodation for people working directly in the industrial park. The number of industrial parks with accommodation for workers and experts is at 51% nationwide. Especially the number of industrial parks with accommodation for workers and experts in the North is nearly 53%, in which the industrial parks with a distance of less than 30km compared to big cities are more than 70% of the parks with this social infrastructure, other 2 groups are under 50%. But in the South, about 62% of the industrial parks have accommodation for workers and experts. In, all 3 groups of industrial parks within the distance have a number of accommodations for workers and experts at a high rate. In Central, there are not many industrial parks of this type.

About 62% of the industrial parks in the country have utility services for laborers in the industrial park or near the industrial park. Although building housing for workers and experts in the South and in the Central have not been paid attention to, other social facilities for laborers such as trade centers, supermarkets, markets, hospitals, schools, and banks are infrastructures that are more interested in these 2 regions. In the central, about 93% of the industrial parks have social utility infrastructures in the industrial park or near these social utility infrastructures. And in the South, this finger is 67%. In general, area of industrial parks in the country, more than 60% of industrial parks have these social utility infrastructures.

In addition, we recognize that 6 industrial parks in the country have a one-stop service, while, in the South, there are 5 industrial parks. This is a new service of the industrial parks providing full supporting service before, during, and after building, installing the factories of the investors and the labors will help the industrial parks in Vietnam increase more competitive ability, especially 2 factors are the most attractive: cheap labor and preferential tax are getting tighter and tighter.

Land leasing prices in the industrial parks

Industrial land for rent is the most popular and oldest developed form of industrial real estate in Industrial Parks in Vietnam. Based on a survey of 258 active industrial parks, we found that 33% of the industrial land banks are leased for less than 50 USD/m2/lease period, and 26% of industrial parks with land leasing prices from 51-70 USD/m2/lease period. Especially in 2021, there have appeared a number of industrial parks with land leasing prices of more than 200 USD/m2/lease period, mainly in the South, although it only accounts for 3%, it also shows that the land rent has increased especially in the Southern Region in the past year.

Nowadays, ready-built factories are very attractive and have an increasing scale of investment capital but mainly towards the projects with a factory scale that is not too large and complicated as well as requires high technology. High-tech ready-built factories are tending to increase in recent years because the State has supporting policies, creating momentum for the development of high-tech industrial parks. However, this ratio is not much, and the fact that currently, high-tech industrial parks in Vietnam have not fully developed yet so they have not attracted many investors. Currently, Vietnam still mainly concentrates on the heavy industry with little high technology requirement so this type of real estate has not increased too fast. The increasing need of investors as well as the focus on the quality of factories of industrial park investors currently contributes to increasing more choices for the investors when referring to the industrial park market in Vietnam.

The new industrial parks in 2022

According to the HOUSELINK data, in the first 6 months of 2022, about 27 new industrial parks are added to the country. In which, the Northern region is added the most with 15 parks, the Southern region is 7 parks and in the Central, there are 5 parks. In both quantity and planning areas, the new industrial parks in the North account for the majority, showing that the supply of provinces in the North is ready to take over new investment capital in the next years.

Status of some investment projects for the industrial park

Real estate of newly registered FDI projects in 2021 and the first 6 months of 2022 was very developed. Whereby, we can see that the trend of warehouse rental was raising both sides in a number of projects and registered investment capital. Especially in 2022, this trend is more and more clearly expressed when the number of warehouse rentals in the first quarter of 2022 raised 132% than the fourth quarter of 2021 and raised 193% over the same period of 2021. In the second quarter of 2022, the number of warehouse rental projects also raised 100% over the same period of 2021. The scale of investment capital of warehouse rental projects was also highly raised when the total registered investment of newly registered FDI projects in 6 months of 2022 up to 93% over the same period of 2021. Meanwhile, land lease projects were, on the contrary, both numbers of projects and investment capital scale were trending decreased.

In the first 6 months of 2022, we concluded that the textile industry was the industry that had many newly registered FDI projects. After that was: Electronic, metal, logistic, footwear,v..v. As we can see, textile was the industry that got much FDI capital in all 3 domains. Especially in central and southern, this was the industry that attract the most projects. And in northern, electronic and logistic was still top industry. This is completely matched with industrial park infrastructure in 3 domains. In Southern, a long time ago, textile was very developing because this was the convergence of many big textile projects, moreover, IPs from southern had a good infrastructure and an abundant number of workers. In northern, factories and warehouse for the logistic industry was very focusing on investment. Moreover, Nothern had a lot of IPs that invested in high-tech infrastructure, import of special electronic materials from China had many advantages in terms of geographical location, and traffic infrastructure had been improved so that it can attract FDI inflows in the electronic industry.

Industrial Parks attract most newly registered FDI projects in the first 6 months of 2022

When analyzed about the top 10 IPs, we conclude that from the beginning of the year until now, the Industrial Parks selection trend of FDI investors was still leaning towards the location of IPs that are convenient in terms of geographical location. When 80% of every industry is adjacent to the route and more than 50% of them only less than 30km from the port/airport/highway.

.jpg)