The Global semiconductor market size reached 580B$ in 2022 and is forecasted to reduce slightly in 2023 (557B$) due to the global economic downturn, increasing political conflicts, high inflation, and many countries implementing interest rate hikes, demand has decreased, and there is still a surplus of inventory. With a compound annual growth rate of 6%, in 2030 and 2040, this market is expected to reach 837B$ and 1499B$ thanks to the development of product applications such as: Electronics, Automotive, AI, v.v.

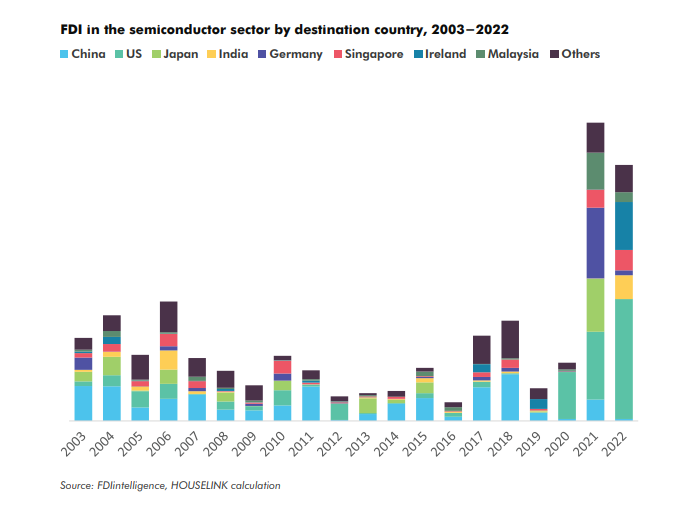

In just two years, 2021 and 2022, the world has witnessed a total Foreign Direct Investment (FDI) capital influx into the semiconductor industry of approximately 155 billion USD. This is the highest FDI inflow level in this industry in the past 20 years. The amount of FDI capital invested in China’s semiconductor industry has significantly decreased (China only accounted for 3% of FDI attraction in the semiconductor industry in 2020). There has been growth in Foreign Direct Investment (FDI) attraction in the United States and in some other countries: Japan, Germany, India, Malaysia, and Ireland.

China, the United States, Germany, France, and Japan are among the largest importers of semiconductors in the world. Meanwhile, Taiwan and South Korea are among the largest exporters. Export and import growth have continued to trend upward since 2019, although the growth rate in 2022 has somewhat declined due to reduced demand for application devices.

In June 2023, Vietnam ranked fourth among Asian countries exporting semiconductors to the United States, following China, Japan and South Korea. Vietnam has the potential to attract investment projects in the semiconductor industry.

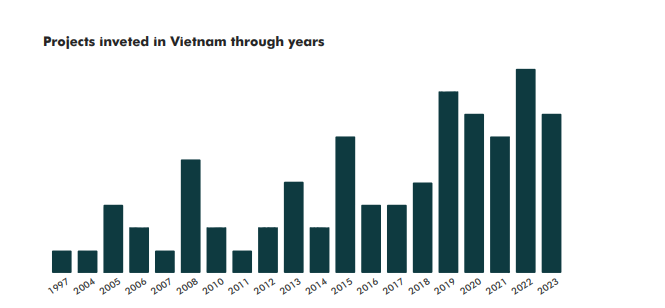

The number of semiconductor industry projects invested in Vietnam is not much, mainly in the field of chip & software design. From 2015 up to now, the project type has been diversified with the entering of other work types, as: simple chip and diode manufacturing, and raw materials projects.